Bank of America recently launched their new Asiana Visa Signature card, there was a lot of interest in it – so a full review is in order! Here are the card basics:

Keep in mind, this is a brand new card so very little application information is available. Please share your data points in the comments at the end of this post.

Common Reasons For Denial:

It depends on what state you live in, you can find out more information by clicking here.

| Minimum Credit Limit | Highest Reported Credit Limit | Average Credit Limit |

|---|---|---|

| N/A | N/A | N/A |

This card comes with three main benefits (as well as no foreign transaction fees which is becoming standard for most travel cards):

Let’s take a look at each benefit in some more detail

Unlike other programs that automatically deposit miles into your account, this benefit is a little bit more complicated. Every year in the month of your anniversary date (due to this wording, I believe you don’t get this in your first year. But this comment on Flyertalk says you get it in the first year as well) you’ll receive a certificate that is good towards:

To use the certificate for Asiana award travel or cabin class upgrades, you must fax the certificate to the Asiana Reservation center at 213-380-1688. The name on invitiation, certificate and Asiana Airlines credit card must also match. Blackout dates might also apply (I’m unsure what these blackout dates are). You may also be issued a 1099 tax form for the value of this certificate, although they do say it has no cash value so I’m also unsure if they’ll actually send out this form or not.

Basically how this certificate is that you fax it along with the flights you want and it’ll reduce the cost of that flight by 10,000 miles. It’s only available on Asiana Awards and not Star Alliance partner awards. If your flight/upgrade/bag excess is less than 10,000 miless then you’ll lose the remaining value.

This isn’t an instant $100 discount, but a rebate. When you purchase an Asiana Airlines ticket you’ll receive a rebate of $100, to receive the rebate you must book through Asiana Airlines (e.g no third parties) and use your Asiana Airlines credit card. The $100 rebate will post within 1-2 billing cycles. You’ll be able to use this benefit in the first year your a cardholder. According to this comment on Flyertalk this credit is based on a calendar year, so you could use it twice (e.g now and then again in January 2017) and only pay the one annual fee.

Every year in the month of your anniversary date you will receive two lounge invitations. You must present the lounge invitations along with your credit card to the Asiana check in counter to receive your complimentary pass. These passes are only valid for Asiana lounges operated in the U.S. It also seems like the lounge passes can only be used by the primary cardholder as you’re limited to one invitation per person per visit.

I’m unsure on if you’ll receive this in your first year or not, but I suspect you will.

This card earns Asiana airline miles.

This card earns at the following rates:

This is a new card and has always had the same sign up bonus

Your miles can be used for award flights, seat upgrades and additional services (e.g lounge access and excess baggage). One of the nice things about Asiana is that you can pool you miles between up to five family members.

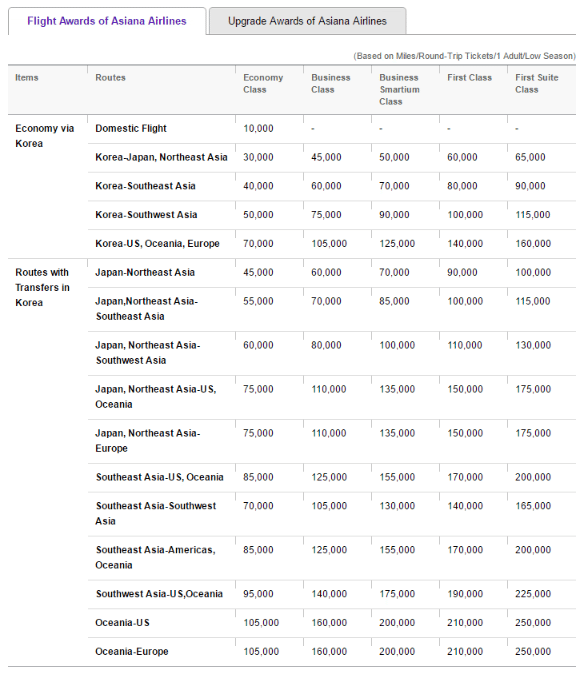

Here is the award chart for redeeming Asiana miles on Asiana. Remember you will need to book your award ticket on Asiana to use your 10,000 mile certificate.

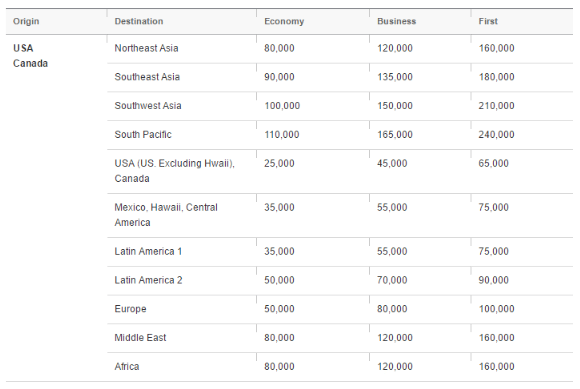

Bank of America cards are extremely popular at the moment because of the ability to combine multiple cards applied on the same day into a single hard inquiry. The downside to Asiana is the fact they charge heavy fuel surcharges. The other issuer is that 30,000 miles (really a minimum of 33,000 miles) isn’t enough for any awards apart from internal flights in the USA and Canada. The bright side is that you can pool miles with family members. The only transfer partner is SPG, so there aren’t a lot of options there either.

This is obviously a really attractive card for people that have paid flights with Asiana as it’ll earn 3x miles on those purchases and the $100 discount covers the annual fee. That being said, at the moment it would make more sense to cancel the card after the first year to free up credit limit space with Bank of America for additional cards. This is nowhere close to being a must have, but I hope Bank of America sticks with this 30,000 mile bonus and even offers slightly higher temporary bonuses in the future (like they have with the Alaska card).

This card makes the more sense when you’re already applying for another Bank of America card. Let’s also hope that the bonus on the business card is increased from 10,000 miles (with Alaska, this was also increased after the personal card originally had it’s bonus increased).

We Recommend This Card For:

We Don’t Recommend This Card For:

We will add to this section over time.